how much state tax do you pay on a 457 withdrawal

457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Use this calculator to see what your net withdrawal would.

What Is A 457 B Plan How Does It Work Wealthkeel

You cant put the money back.

. 457 Plan Withdrawal indicates required. 65 as government super funds will have an untaxed component which will generally be taxed. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made.

Pending foreclosureeviction from a primary residence Medical expenses Funeral expenses. Also known as a. If you have a 457b you can withdraw the budget from your account without any early withdrawal penalty.

How much tax do you pay on a 457 withdrawal. Its a permanent withdrawal from your TSP account. How much tax do you pay on superannuation withdrawal when leaving Australia.

The current state marginal tax rate you. The current state marginal tax rate you expect to pay on any additional income or taxable distributions. Can you withdraw money from 457b.

How Withdrawals Work. You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. In most circumstances an early.

If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½. One of the most well known rules when it comes to the TSP is the rule of 59 and ½. Enter an amount between 0 and.

When you make a withdrawal from a 401 account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. This entry is required. 457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

For example if you fall. Press spacebar to hide inputs. However if you save on the 403b you will receive a 10 penalty on.

Basically any amount you withdraw from your 401 k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return. 457 Plan Withdrawal Calculator Definitions. If you do not wait until the age of 59-12 to withdraw your 401 k funds you may pay a penalty tax in addition to federal state and local taxes.

For example if you fall in the 12 tax. Amount to withdraw.

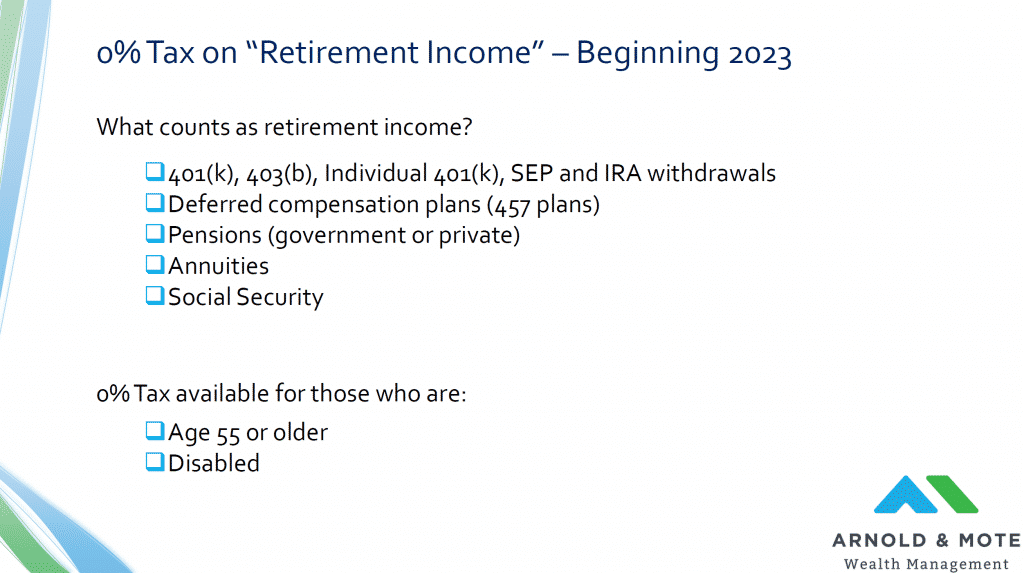

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Can You Maximize A 401k 403b And A 457 Wrenne Financial Planning Lexington Ky

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

What Are Defined Contribution Retirement Plans Tax Policy Center

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

Should You Make Pre Tax Or Roth 401 K Contributions Greenbush Financial Group

The Cost Of Cashing Out Retirement Plans Early Equitable

Deferred Compensation Plan Archives New York Retirement News

A Guide To 457 B Retirement Plans Smartasset

What Is A 457 B Plan Forbes Advisor

Deferred Compensation Plan Opa

403 B Vs 457 B What S The Difference Smartasset

How Can I Get My 401 K Money Without Paying Taxes

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Retirement Withdrawal Tax In Illinois

457 B Opportunities For Tpa Business Owners This Session Is Geared To 401 K Administrators Who Want To Learn About 457 B Plans And Includes A Comparison Ppt Download