triple bottom stocks meaning

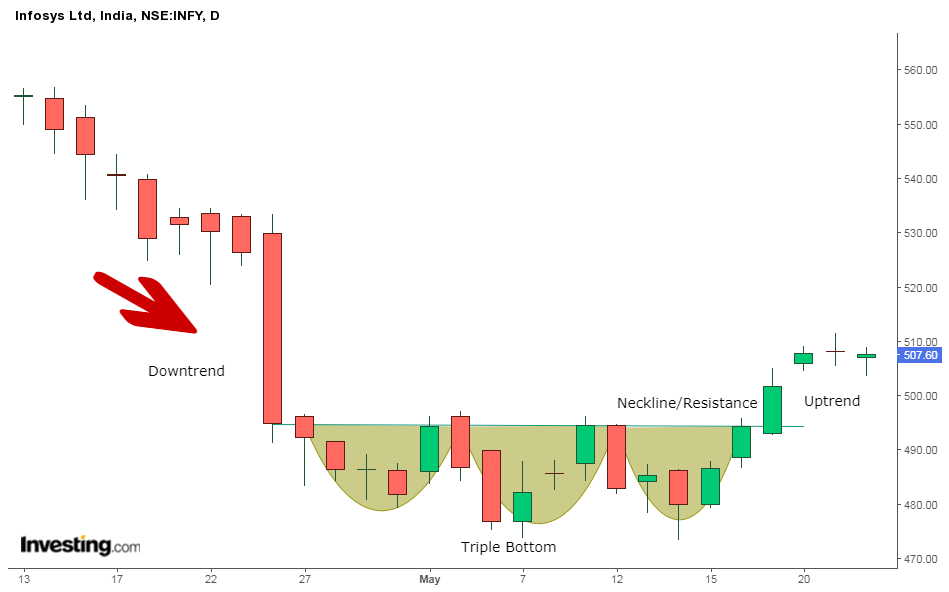

Because of its long-term nature weekly charts can be best suited for analysis. The Triple Bottom Stock Pattern is a chart pattern used in technical analysis thats identified by three equal lows followed by a breakout above the resistance level.

The Triple Bottom Candlestick Pattern Thinkmarkets En

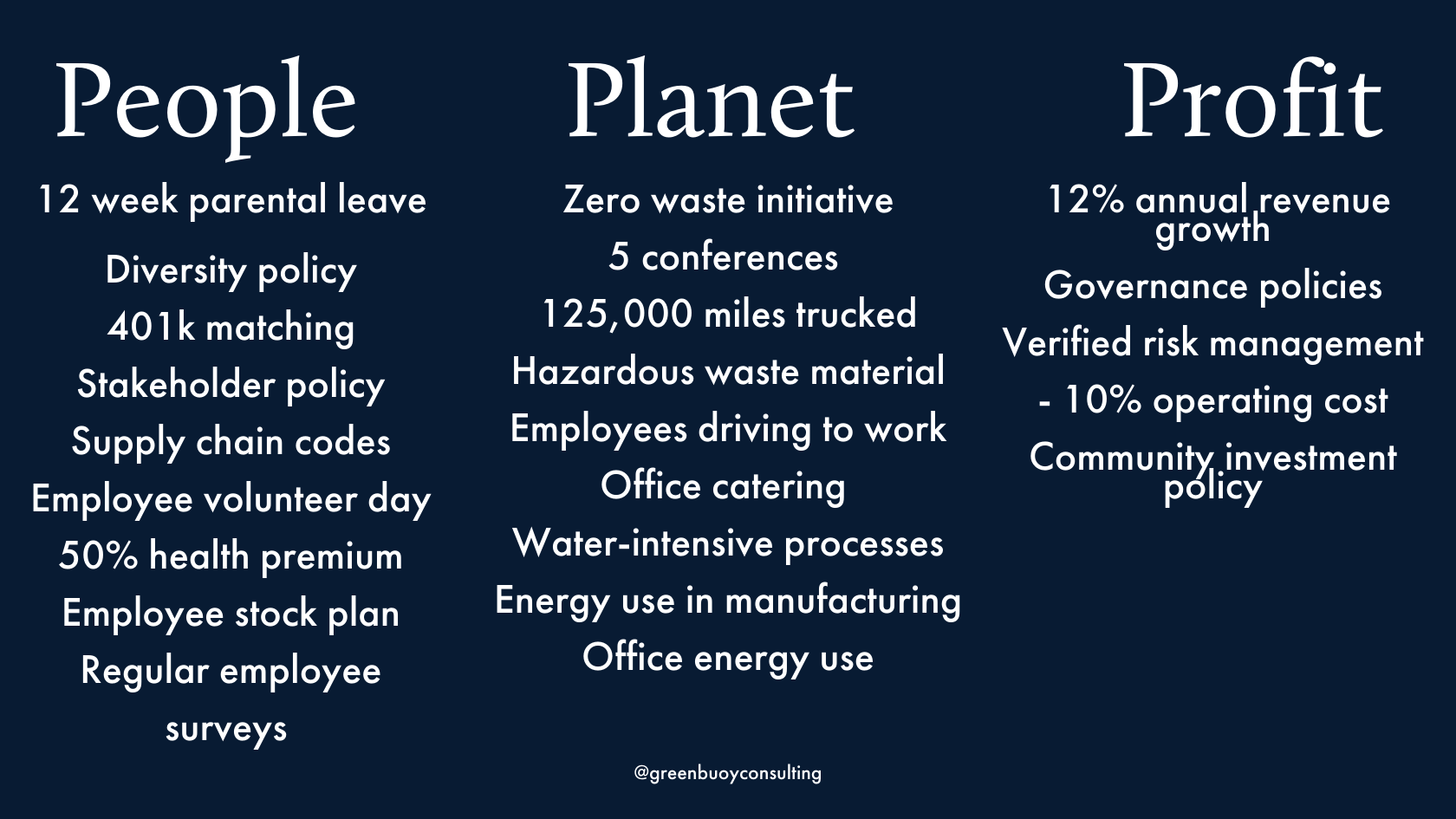

Additionally the triple bottom line works to include the environmental and.

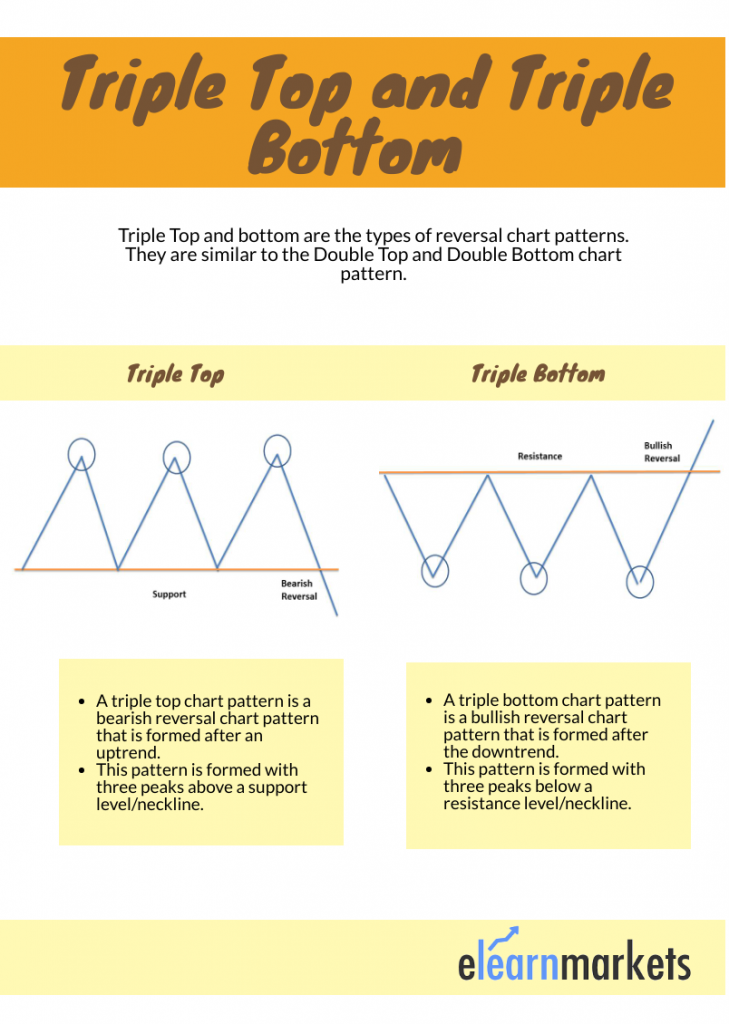

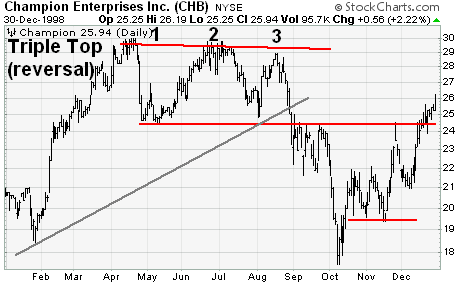

. It consists of three valleys or support levels. The opposite of a Triple Top is a Triple Bottom obviously and we will talk about that in another article. Triple Bottom - Triple Bottom Pattern A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance.

The triple bottom line is an accounting framework that incorporates three dimensions of performance. After the first valley is formed price goes up either quickly or gradually. This means it is essential to the validity of the pattern that it begin with a downward trend in a.

This means implications there have been three failed attempts at making new lows in the same area followed by a price move up through resistance. How A Triple Top Stock Pattern Develops Ive also learned that the Triple Top Stock Pattern is basically a reversal pattern. A triple bottom is a bullish chart pattern used in technical analysis thats characterized by three equal lows followed by a.

Social environmental and financial. This pattern is generally found within low trading ranges following downtrends and the break of resistance which confirms this pattern is what. The Triple Bottom Reversal is a bullish reversal pattern typically found on bar charts line charts and candlestick charts.

Triple top and triple bottom are reversal chart patterns used in the technical analysis of stocks commodities currencies and other assets. This pattern is rare but a very reliable buy signal. As major reversal patterns these patterns usually form over a 3- to 6-month period.

The triple bottom pattern a bullish reversal pattern used to predict the bottoming of stock that has been in a downtrend. This approach suggests that there should not be one but three bottom lines that a company adheres to. The pattern can be found on bar charts line charts and candlestick patterns with a distinct bounce off a support level three times.

Now that you clearly understand the bottom line and triple bottom line concepts you will find it easier to get your mind around the quadruple bottom line definition. What is a Triple Bottom. It is an economic concept that includes three aspects in its functioning.

Its created when price bounces off support 3 time at similar levels. In a nutshell a bottom line is a final number generated from an extensive sheet of expenses and profits of a certain company. Schabacker and Murphy agree however that the longer the pattern takes to form the greater the significance of the price move once breakout occurs.

Need for a Downtrend The triple bottom is a reversal pattern. Triple Bottom Line is an accounting approach that focuses on creating a sustainable method of execution for corporates. This pattern is rare but a very reliable buy signal.

The triple bottom pattern is a bullish reversal pattern. The Triple Bottom stock pattern is a reversal pattern made up of three equal lows followed by a breakout above resistance. Triple bottom patterns are a bullish pattern.

Triple Bottom Chart Pattern Triple Bottom is a chart pattern with three bottoms very close in price. Its a sign the buyers are coming in the market to. After that price moves back down to the first valley level and it holds that first support level thus creating a double bottom.

The triple bottom is one of the longer patterns to develop. After that price moves up then pulls back down to the first and second support. A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance.

Social environmental and financial. There are three equal lows followed by a break above resistance. While this pattern can form over just a few months it is usually a long-term pattern that covers many months.

These three facets can be summarized as people planet.

Triple Bottom Reversal Chartschool

The Complete Guide To Triple Top Chart Pattern

Trading Tips With Triple Top And Triple Bottom Chart Patterns Http Www Forexabode Com Forex School Watch Out For Trading Charts Stock Market Forex Trading

Triple Bottom Pattern And Triple Top The Ultimate Guide

The Complete Guide To Triple Top Chart Pattern

Tutorials On Triple Bottom Chart Pattern

Triple Bottom Reversal Chartschool

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Top Reversal Chartschool

/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Top Pattern Explained Stock Chart Patterns

The Triple Bottom Candlestick Pattern Thinkmarkets En

The Triple Bottom Candlestick Pattern Thinkmarkets En

The Complete Guide To Triple Top Chart Pattern

Tutorials On Triple Bottom Chart Pattern

What Are The Chart Patterns In Price Action Trading Quora